Apr 24, 2020

Problem

Small business owners were struggling with cash flow constraints due to delayed payment from their brokers.

Outcome

$16 million dollars factored through the mobile experiences. Additionally, nearly 30,000 credit line checks have been conducted, ensuring future business opportunities with TBS.

Role

Senior Product Designer

Overview

TBS Factoring Service is dedicated to supporting truckers in effectively managing their businesses by providing cash flow solutions, insurance coverage, compliance/permitting assistance, and authority processing. With their comprehensive range of services, TBS aims to alleviate the common challenges faced by small business logistics owners and operators.

Problem Statement

The cash flow solutions available to small business logistics owners often fall short, leading to potential disruptions that can keep them out of business for weeks. Balancing freight scheduling with cash flow timing becomes a constant juggling act, exacerbated by the lack of transparency in the factoring invoice tracking process. Operators find themselves at the mercy of vendors who pay invoices on a delayed schedule that fails to align with their immediate needs.

Users and Audience

Our earliest tasks centered around understanding the current business processes internally and the external influence on truck drivers, specifically the work flows they had to complete to factor with TBS. Alongside these critical jobs-to-be-done, we had to spend time with our audience. Who are they? What are their goals and problems they need TBS to solve? We found three common patterns across our customers:

John - a seasoned business owner and operator seeking consistency in factoring invoices. He values transparency in the process while being reluctant to change his established workflows.

Allison - a front office manager responsible for managing multiple trucks and front office activities. She thrives in structured, process-driven environments and seeks greater transparency.

Juan - a young and ambitious freight broker who is new to the industry. He is open to embracing new technologies that can provide him with a competitive edge and advantages in the field.

Roles and Responsibilities

As the founding product designer, I played a pivotal role in collaborating with the CEO, CTO, and the initial engineering team to develop the TBS GetPaid mobile app. Additionally, I actively contributed to defining product development cycles, establishing career levels for Product Designers, and implementing meeting and critique processes.

The core team included the CEO, CTO, and Product Manager Justin Battenfield

iOS Developer - James McPherson

Android Developer - Robert Owens

Software Engineers - Jayson Bucy and Cassie Koelsch.

Scope and Constraints

During our research we found three key areas we would have to better understand and overcome:

Legacy invoicing software and limited data records posed initial challenges.

Recent digital transformation efforts aimed to replace faxed paperwork with more efficient digital processes.

The involvement of the new Product Team necessitated stakeholder alignment to ensure a smooth transition.

Process and What Happened

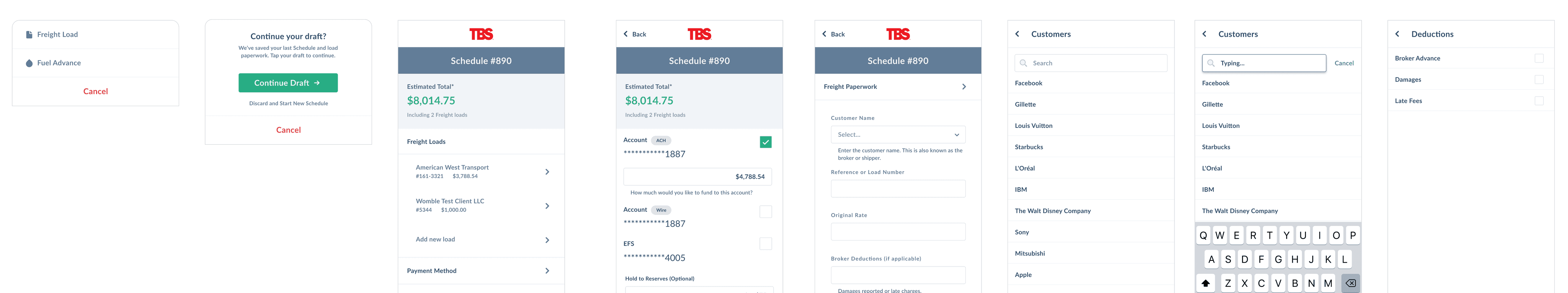

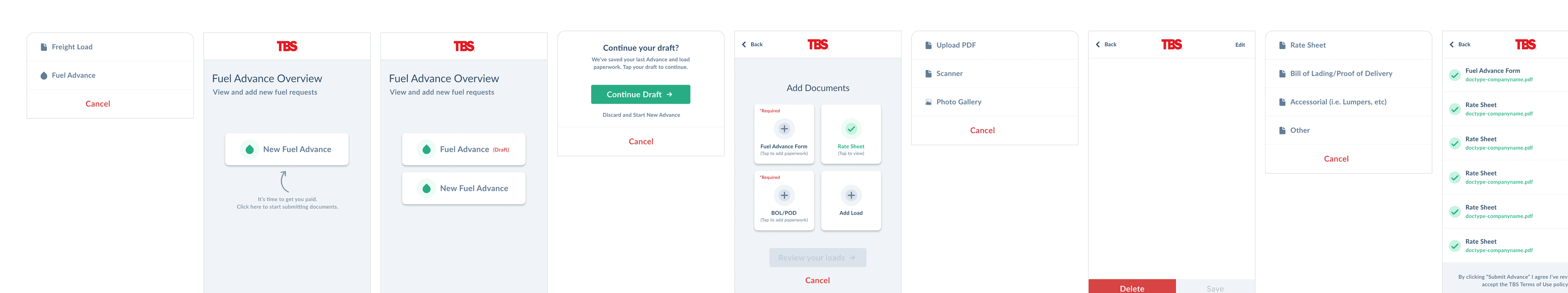

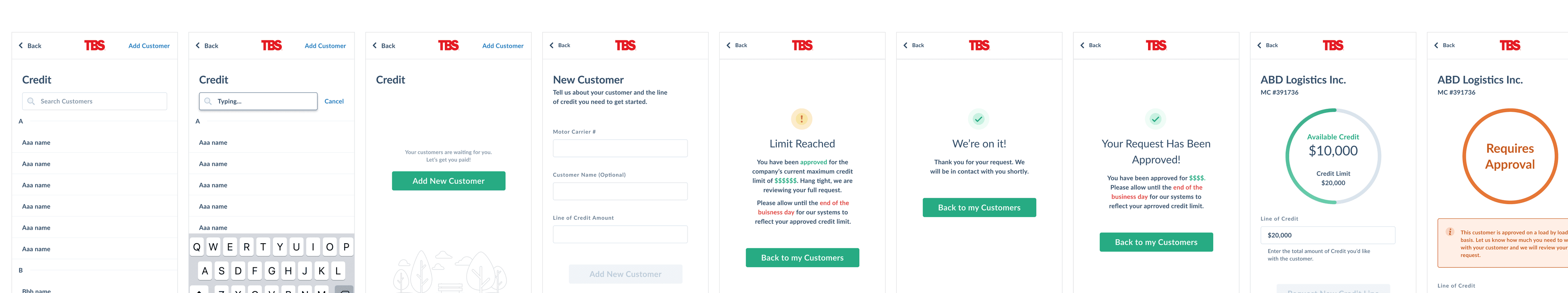

The existing business processes relied heavily on faxed paperwork, limiting capabilities while on the road and providing no real-time status updates on invoice payments. Manual data entry by TBS after submission further extended processing times. Overcoming roadblocks to receive payment required engaging with different departments, such as credit line availability. Talks with customers and a comprehensive usability study were conducted to capture primary tasks in submitting an invoice schedule to TBS.

Outcomes and Results

Following the launch, there was a significant shift towards utilizing the TBS Factoring app for submitting invoice schedules. Today, the majority of TBS customers rely on the app daily, resulting in over $16 million dollars factored through the mobile experiences. Additionally, nearly 30,000 credit line checks have been conducted, ensuring future business opportunities with TBS. Throughout the process, several valuable lessons were learned, including the importance of frequent iterations, embracing the concept of "good" over perfection, attentive listening to customer feedback, recognizing the distinction between oneself and the user, and acknowledging the interconnectedness of people's problems.

In conclusion, TBS Factoring Service has successfully addressed the cash flow challenges faced by small business logistics owners and operators through their innovative mobile app. By fostering transparency, streamlining processes, and prioritizing customer needs, TBS has significantly transformed the way trucking businesses operate and manage their finances.